New York Low Voltage and AV Contractors Insurance

See How We're Different:

or Call Us: 212-425-8150

Most Common Business Policies

Index

Contact Us

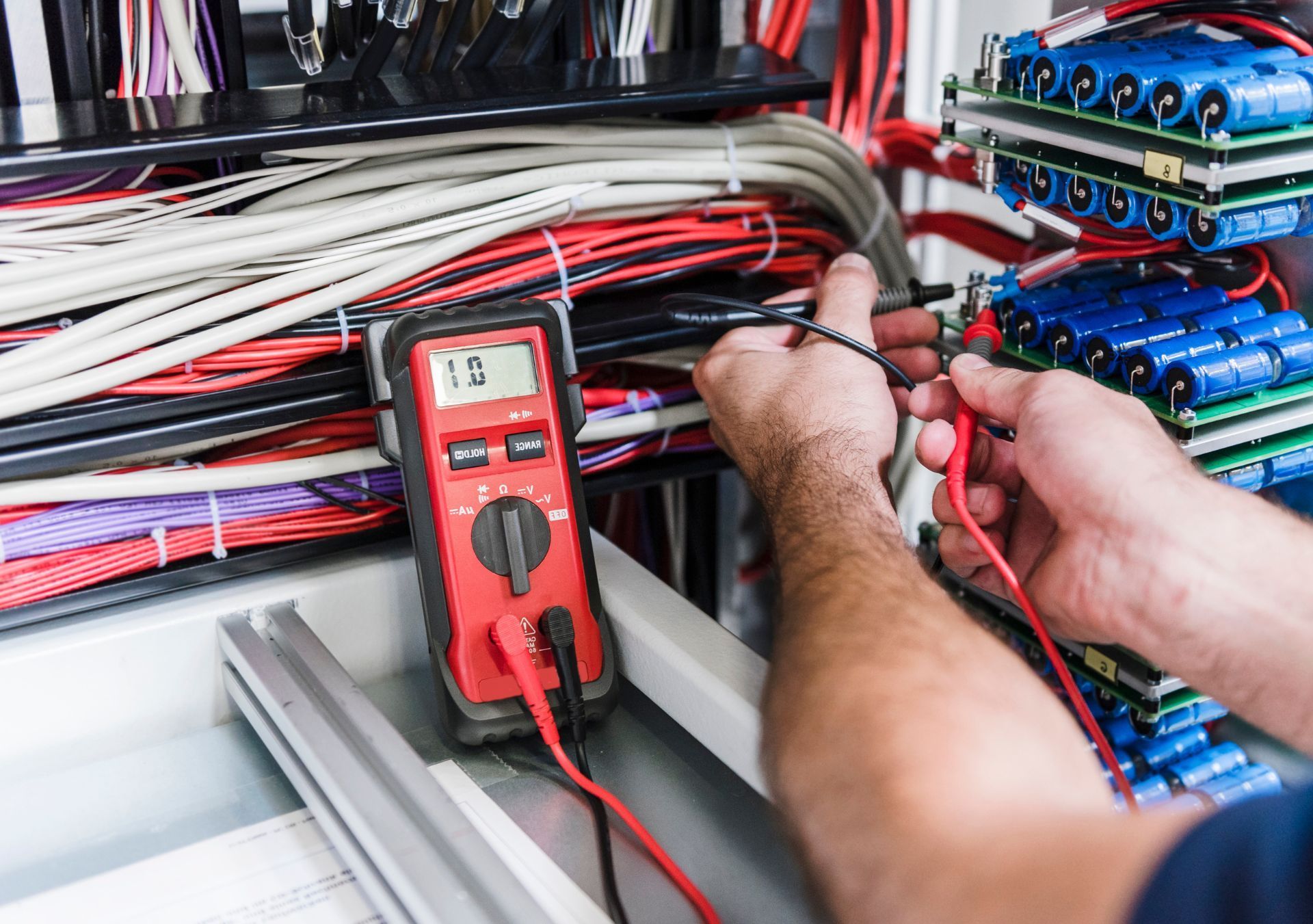

Low voltage and audiovisual (AV) contractors in New York operate in a demanding environment where insurance coverage is not just a formality but a critical business safeguard. Whether installing security systems, sound equipment, or smart home technology, these contractors face unique risks that require tailored insurance solutions. Understanding the specific insurance requirements and costs in New York can make the difference between winning jobs and facing costly legal troubles.

New York’s construction market is one of the most competitive and heavily regulated in the country. Subcontractors, including those specializing in low voltage and AV work, encounter more insurance mandates than ever before. General contractors often scrutinize insurance policies to ensure compliance, especially regarding Workers’ Compensation and liability coverage. This article breaks down the essentials of insurance for low voltage and AV contractors in New York, highlighting what you need to stay compliant and protect your business.

For a detailed look at the insurance requirements subcontractors face in New York, the

BGES Group Insurance provides an excellent overview of must-have coverages.

Mandatory Insurance Coverage for Low Voltage and AV Contractors

One of the first things low voltage and AV contractors in New York must understand is the state’s strict insurance requirements. New York law mandates that all contractors carry Workers’ Compensation insurance for their employees, including part-time workers. This is not optional—failure to maintain this coverage can lead to criminal misdemeanor charges.

Workers’ Compensation protects employees if they suffer work-related injuries or illnesses. For subcontractors, this coverage is often a prerequisite to secure contracts with general contractors, who typically require proof that policies cover New York operations. This requirement extends to all workers on the jobsite, ensuring protection across the board.

Aside from Workers’ Compensation, General Liability insurance is essential. This coverage protects contractors from claims related to property damage, bodily injury, and related legal costs. In New York, the minimum coverage for general liability insurance often starts at $1 million per incident, especially for trades like HVAC contractors, which share similar risk profiles with low voltage work. While low voltage and AV contractors might not face the exact same risks as HVAC professionals, these standards set a useful benchmark for the industry.

For more insight into New York’s insurance mandates for subcontractors, the Contractors Choice Agency offers a comprehensive compliance guide that highlights the importance of Workers’ Compensation and liability coverage.

Why These Coverages Matter

Low voltage and AV contractors often work in environments where electrical components, wiring, and expensive equipment are involved. A single accident—like an electrical shock or damage to a client’s property—can result in significant claims. Workers’ Compensation ensures that injured employees receive medical care and wage replacement without the contractor facing lawsuits. Meanwhile, General Liability insurance covers claims from third parties, including clients or bystanders.

Without these coverages, contractors risk not only financial loss but also losing the trust of general contractors and clients, which can hinder business growth. Additionally, the landscape of technology and low voltage systems is continuously evolving, with new products and installation techniques emerging regularly. This rapid change can introduce unforeseen risks and liabilities, making it even more critical for contractors to stay ahead of insurance requirements. Furthermore, having robust insurance coverage can enhance a contractor's reputation, as clients are more likely to engage with businesses that demonstrate responsibility and foresight in risk management.

Moreover, in an industry where projects often involve collaboration with multiple stakeholders—including architects, engineers, and other subcontractors—having comprehensive insurance coverage can facilitate smoother project execution. It provides peace of mind not just for the contractors but also for all parties involved, ensuring that everyone can focus on delivering quality work without the looming fear of potential liabilities. As the demand for low voltage and AV systems continues to grow, understanding and adhering to these insurance requirements will be essential for contractors aiming to thrive in this competitive market.

Cost Expectations for Insurance in New York

Understanding insurance costs is critical for budgeting and bidding on projects. For low voltage and AV contractors, insurance premiums vary based on factors like business size, number of employees, and the scope of work. While specific data for low voltage contractors is limited, insights from related trades offer useful guidance.

For example, a sole proprietor electrician in New York can expect to pay between $600 and $800 annually for Commercial General Liability insurance. This figure provides a reasonable estimate for small-scale low voltage contractors with similar risk profiles. Larger operations or those with multiple employees will see higher premiums, especially when factoring in Workers’ Compensation coverage.

HVAC contractors, who face comparable risks related to equipment and property damage, often carry General Liability insurance with minimum coverage amounts starting at $1 million per incident. Their premiums reflect the higher stakes involved in their work, which can inform expectations for low voltage contractors operating at a similar scale.

For a closer look at insurance costs for electricians and contractors, Drickard Insurance provides detailed pricing insights that can help low voltage contractors estimate their insurance budgets.

Factors Influencing Premiums

Several elements affect insurance premiums for low voltage and AV contractors in New York:

- Business Size: More employees mean higher Workers’ Compensation costs and potentially higher liability exposure.

- Project Scope: Large commercial projects may require higher coverage limits.

- Claims History: A history of insurance claims can increase premiums.

- Safety Practices: Contractors with strong safety protocols may benefit from lower rates.

Understanding these factors helps contractors tailor their insurance coverage to their specific needs without overpaying. Additionally, the type of work being performed can also influence costs significantly. For instance, contractors who frequently work in high-risk environments, such as construction sites or areas with heavy foot traffic, may face steeper premiums due to the increased likelihood of accidents or property damage. This highlights the importance of conducting thorough risk assessments and implementing robust safety measures to mitigate potential hazards.

Furthermore, the geographical location within New York can also play a role in determining insurance costs. Urban areas like New York City may have higher premiums due to the dense population and increased likelihood of claims, while rural areas might see lower rates. Contractors should consider these regional differences when budgeting for insurance, as they can significantly impact overall project costs. Engaging with local insurance agents who understand the specific risks associated with low voltage and AV work in various New York locales can provide valuable insights and potentially better rates.

Special Considerations for Low Voltage and AV Contractors

Low voltage and AV contractors face unique risks that standard insurance policies might not fully cover. These include damage to expensive AV equipment, data loss, and installation errors that could disrupt client operations. While General Liability and Workers’ Compensation form the insurance backbone, additional coverages might be necessary. The complexity of AV systems often requires contractors to stay updated with the latest technologies, which can further complicate the risk landscape. As technology evolves, so do the potential liabilities associated with it, making it essential for contractors to regularly review their insurance needs.

Professional Liability Insurance

Also known as Errors and Omissions insurance, Professional Liability protects contractors against claims arising from mistakes or negligence in their professional services. For AV contractors, this could cover faulty system designs or installation errors that cause operational failures. Although not always mandatory, it is highly recommended to mitigate risks inherent in technical work. The stakes can be particularly high in environments such as corporate offices or educational institutions, where a malfunctioning AV system can lead to significant disruptions and financial losses. This insurance not only safeguards the contractor but also enhances their credibility and trustworthiness in the eyes of clients.

Equipment Coverage

Low voltage and AV contractors rely heavily on specialized tools and equipment. Insurance that covers theft, loss, or damage to this equipment can prevent major financial setbacks. Contractors should consider Inland Marine insurance or specific equipment policies tailored to their business. Additionally, as equipment becomes more advanced and costly, ensuring that the coverage limits are adequate to replace or repair high-end devices is crucial. Many contractors also find it beneficial to keep an inventory of their equipment, documenting serial numbers and purchase dates, which can expedite the claims process in the event of a loss.

Additional Insured Endorsements

General contractors often require subcontractors to add them as Additional Insureds on liability policies. This extends coverage to the general contractor and is a common contractual requirement in New York’s construction market. Being prepared to provide this endorsement can streamline contract negotiations and improve trust. It not only protects the general contractor from claims arising from the subcontractor's work but also fosters a collaborative environment where all parties feel secure. Understanding the nuances of these endorsements can help contractors navigate complex contractual obligations and ensure compliance with industry standards.

The

Feltner Group discusses how these endorsements play a role in contractor insurance, especially for trades with high liability exposure. Furthermore, as the construction landscape continues to evolve, staying informed about changes in insurance requirements and best practices can provide contractors with a competitive edge. Regular training and workshops on risk management and insurance can also empower contractors to make informed decisions that protect their business and enhance their service offerings.

How to Stay Compliant and Competitive

Insurance compliance in New York is non-negotiable for low voltage and AV contractors. Beyond legal requirements, having the right insurance coverage signals professionalism and reliability to general contractors and clients. Here are key steps contractors can take:

- Verify Coverage Limits: Ensure your policies meet or exceed New York’s minimum requirements, especially for Workers’ Compensation and General Liability.

- Maintain Updated Documentation: Keep certificates of insurance readily available and updated for each project.

- Work with Experienced Brokers: Insurance brokers familiar with New York’s construction market can tailor policies to your specific risks and help you navigate compliance.

- Review Contracts Carefully: Understand insurance clauses and Additional Insured requirements before signing.

Failing to comply can lead to lost contracts, fines, or even criminal charges. On the flip side, a solid insurance portfolio can open doors to larger projects and partnerships.

For subcontractors looking to win jobs and stay compliant, the BGES Group Insurance offers practical advice on navigating these requirements effectively.

Additionally, it’s crucial for contractors to stay informed about the evolving landscape of insurance regulations in New York. Regularly attending industry seminars and workshops can provide insights into best practices and emerging trends in compliance. Networking with other professionals can also yield valuable information about what coverage options are working best in the field, allowing contractors to adapt their strategies accordingly.

Furthermore, investing in risk management training for your team can significantly enhance your compliance efforts. By educating employees about safety protocols and the importance of adhering to insurance requirements, you not only reduce the likelihood of accidents but also foster a culture of accountability. This proactive approach can be a game-changer, positioning your company as a leader in both compliance and quality within the competitive landscape of low voltage and AV contracting.

Insurance Coverage Comparison for Low Voltage and AV Contractors

| Coverage Type | Purpose | Typical New York Requirements | Relevance to Low Voltage/AV Contractors |

|---|---|---|---|

| Workers’ Compensation | Protects employees injured on the job | Mandatory for all contractors with employees; criminal misdemeanor if missing | Essential for employee safety and legal compliance |

| General Liability | Covers third-party bodily injury and property damage | Minimum $1 million per incident recommended | Protects against client property damage and injury claims |

| Professional Liability | Covers errors and omissions in professional services | Not mandatory but highly recommended | Protects against design or installation mistakes |

| Equipment Coverage | Covers loss or damage to tools and equipment | Optional but advisable | Protects costly AV and low voltage tools |

| Additional Insured Endorsements | Extends coverage to general contractors | Often contractually required | Facilitates contract compliance and trust |

Frequently Asked Questions

Do low voltage contractors in New York have to carry Workers’ Compensation insurance?

Yes. New York law requires all contractors with employees to carry Workers’ Compensation insurance, including part-time workers. Failure to do so is a criminal misdemeanor.

What is the typical cost of General Liability insurance for a small AV contractor?

A sole proprietor electrician in New York pays around $600 to $800 annually for General Liability insurance, which can serve as a benchmark for small AV contractors.

Is Professional Liability insurance mandatory for AV contractors?

No, it is not legally required but is highly recommended to protect against claims related to errors or omissions in your work.

Why do general contractors require Additional Insured endorsements?

This endorsement extends your liability coverage to the general contractor, reducing their risk and making them more comfortable hiring your services.

Can I operate as a subcontractor without insurance in New York?

No. Insurance is legally required for subcontractors, and most general contractors will not hire subcontractors without proof of proper coverage.

Where can I find more information about insurance requirements for New York subcontractors?

The

BGES Group Insurance and

Contractors Choice Agency provide detailed guides on this topic.