New York Telecom and Data Cabling Contractors Insurance

See How We're Different:

or Call Us: 212-425-8150

Most Common Business Policies

Index

Insurance Challenges in New York’s Construction and Telecom Markets

Key Insurance Types for Telecom and Data Cabling Contractors

Understanding the Cost Landscape for New York Contractors

Vendor Certification and Its Impact on Contractor Operations

Protecting Your Business: Practical Insurance Advice

Insurance Coverage Comparison for Telecom Contractors

Contact Us

New York City hosts a bustling telecommunications sector, with 135 contractor locations actively serving the area. This dense market comes with its own set of challenges, especially when it comes to securing the right insurance coverage. Contractors face unique risks, from on-site accidents to technology errors, and navigating insurance options can be complicated by local regulations and market conditions. Understanding these factors is crucial for telecom and data cabling contractors who want to protect their businesses effectively.

For those in the industry, knowledge about insurance costs, coverage types, and the impact of New York’s legal environment can make a significant difference. This article breaks down what contractors need to know to stay covered without overpaying or leaving gaps in protection.

Insurance Challenges in New York’s Construction and Telecom Markets

One of the biggest hurdles for contractors in New York is the impact of the Scaffold Law. This legislation makes it difficult to obtain construction-related insurance because many liability carriers have exited the market. Mike Elmendorf, President and CEO of the New York chapter of the Associated General Contractors of America, points out that “most of the carriers that write this type of liability coverage have fled the New York market” due to the risks involved.

As a result, insurance premiums have risen sharply. A 2024 report by BGES Group Insurance highlights that New York contractors are facing rate increases of 20% or more. These hikes are driven by the high-risk environment and regulatory demands unique to the state. Contractors must plan for these costs when budgeting for insurance and consider how coverage gaps could expose them to costly claims.

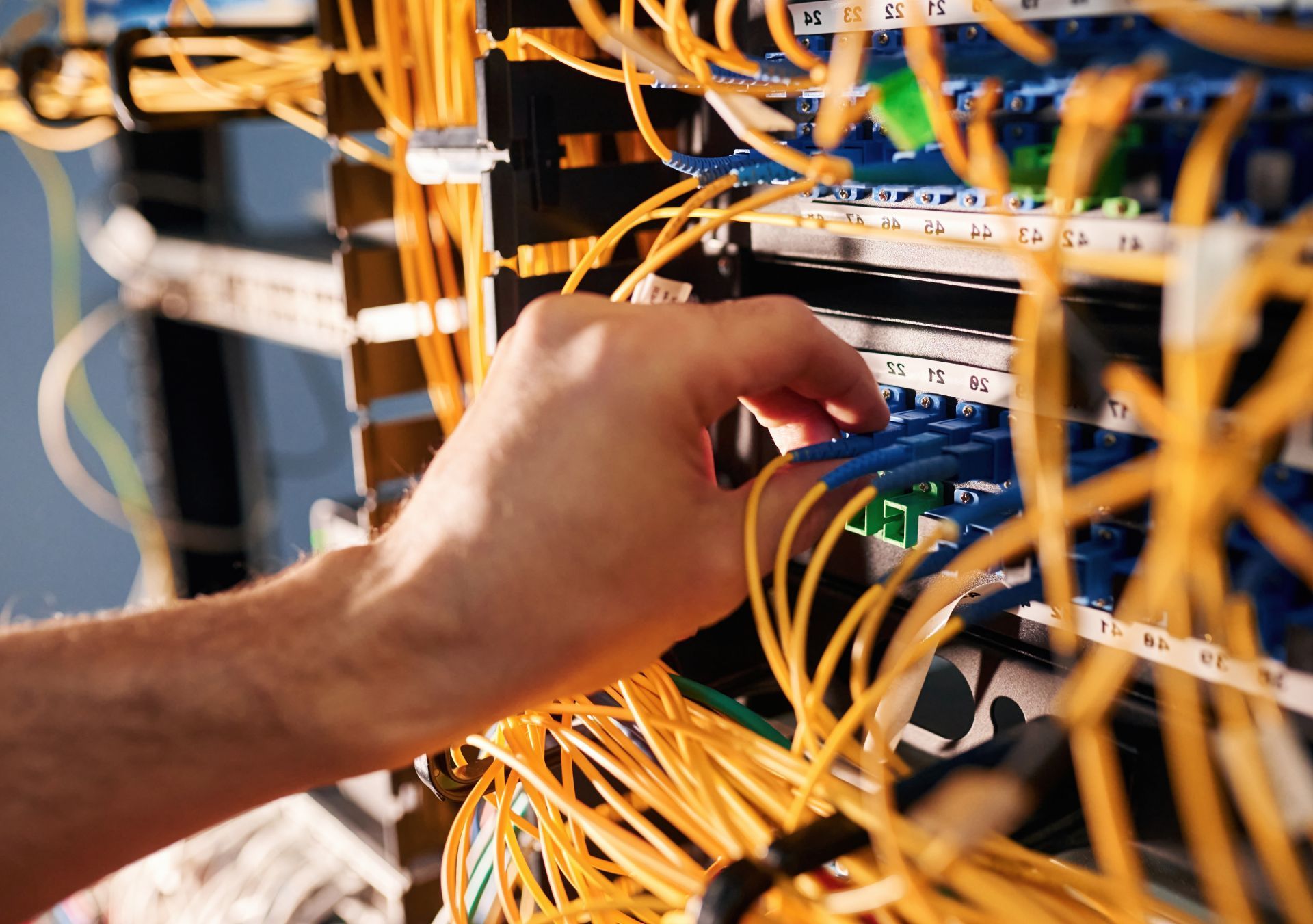

For telecom and data cabling contractors, this environment means that general liability insurance, which covers bodily injury and property damage, can be expensive and sometimes difficult to secure. However, it remains a foundational part of any insurance portfolio. The challenge is compounded by the rapid pace of technological advancement in the telecom sector, which often requires contractors to adapt to new risks associated with emerging technologies. For instance, the installation of fiber-optic cables and advanced networking systems introduces unique hazards that may not be adequately covered under traditional policies.

Moreover, the complexities of urban construction in New York City, with its dense population and extensive regulations, further exacerbate the insurance dilemma. Contractors must navigate a labyrinth of local laws, zoning requirements, and safety regulations, all of which can impact their insurance needs. The interplay between these factors creates a challenging landscape where contractors must not only secure adequate coverage but also stay informed about evolving legal standards and market conditions. This necessitates a proactive approach to risk management, including regular consultations with insurance professionals to ensure that their policies remain relevant and comprehensive in the face of changing industry dynamics.

Key Insurance Types for Telecom and Data Cabling Contractors

Telecom contractors face risks beyond physical injury and property damage. Technology errors and omissions (E&O) insurance is a critical coverage that protects against claims related to mistakes or failures in technology services or products. For telecom companies, this insurance typically costs around $59 per month, making it an affordable way to safeguard against professional liability. This type of coverage is particularly vital in an industry where even minor oversights can lead to significant financial repercussions, such as lost contracts or damaged reputations. By investing in E&O insurance, contractors can not only protect their financial interests but also enhance their credibility in a competitive market.

Cyber insurance is another important consideration. As contractors handle sensitive client data and manage complex network installations, the risk of cyberattacks or data breaches increases. Cyber coverage helps mitigate financial losses from such incidents, including legal fees and notification costs. In today's digital landscape, the ramifications of a data breach can extend far beyond immediate financial loss, potentially leading to long-term damage to client trust and business relationships. Therefore, having a robust cyber insurance policy can provide peace of mind, allowing contractors to focus on their core operations without the constant worry of cyber threats looming over their heads.

General liability insurance remains essential, but contractors should also evaluate whether workers’ compensation and commercial auto insurance are necessary, depending on their workforce and vehicle use. These coverages help protect employees and address risks associated with operating vehicles on job sites. Workers’ compensation is particularly crucial, as it not only covers medical expenses for injured employees but also protects the business from potential lawsuits stemming from workplace injuries. Additionally, commercial auto insurance is vital for contractors who rely on vehicles for transporting equipment and personnel, ensuring that they are covered in the event of an accident while on the job.

Industry experts recommend a layered approach to insurance, combining general liability, tech E&O, and cyber insurance to address the full spectrum of risks. This strategy helps contractors avoid costly surprises and maintain business continuity. Furthermore, as the telecommunications landscape evolves with new technologies and regulatory changes, it is essential for contractors to regularly review and update their insurance policies. This proactive approach not only ensures that they remain compliant with industry standards but also provides a safety net against emerging risks, such as those associated with the Internet of Things (IoT) and the increasing reliance on cloud-based services.

Understanding the Cost Landscape for New York Contractors

Insurance costs in New York are influenced by several factors, including regulatory challenges and market conditions. The Scaffold Law’s impact on liability coverage availability has pushed premiums higher, as noted earlier. For telecom contractors, tech E&O insurance remains relatively affordable, but general liability and workers’ compensation premiums can be steep. Additionally, the complexities of New York's legal landscape mean that contractors must navigate a web of regulations that can vary significantly from one municipality to another, further complicating their insurance needs. This variability can lead to unexpected costs and challenges in securing adequate coverage, particularly for smaller firms that may not have the resources to absorb these fluctuations.

Compensation trends also play a role in insurance costs. A 2020 survey found that lead technicians in the cabling industry earn an average annual salary of $84,207. Higher wages can translate into higher workers’ compensation premiums, as insurers base rates partly on payroll figures. Moreover, as the demand for skilled labor continues to rise, contractors may find themselves competing not just on price, but also on the benefits they offer to attract and retain talent. This competition can drive up overall labor costs, which in turn affects the premiums that contractors must pay. Additionally, the ongoing evolution of technology in the industry means that training and certification costs are also on the rise, further impacting the financial landscape for contractors.

Purchasing habits in the cabling industry also affect operational costs. Nearly three-quarters of cabling contractors buy materials through distributors, which can influence pricing and supply chain reliability. While this does not directly impact insurance, it shapes the overall business environment contractors operate within. The reliance on distributors can lead to fluctuations in material costs based on market demand and availability, which can be particularly pronounced in a city like New York, where construction projects often compete for the same resources. Furthermore, the recent disruptions in global supply chains have underscored the importance of establishing strong relationships with reliable suppliers. Contractors who can secure favorable terms and consistent delivery schedules may find themselves at a competitive advantage, allowing them to better manage costs and, by extension, their insurance premiums.

Vendor Certification and Its Impact on Contractor Operations

Vendor certification is a notable challenge for cabling contractors. To install products from multiple vendors, contractors must complete specific training programs. This certification process can result in lost working time, which affects productivity and profitability.

Balancing the need to represent various vendor lines with the time investment required for certification is a common struggle. Contractors who invest in certifications improve their marketability but must also plan for the indirect costs involved. These operational challenges underscore the importance of having insurance coverage that protects the business during periods of reduced productivity or unforeseen setbacks.

Moreover, the landscape of vendor certification is constantly evolving, with new technologies and standards emerging regularly. As a result, contractors must stay abreast of the latest developments in the industry, which can add another layer of complexity to their operations. For instance, the rise of smart building technologies necessitates that contractors not only understand traditional cabling systems but also become proficient in integrating these advanced solutions. This ongoing education demands both time and financial resources, further complicating the contractor's ability to manage multiple vendor relationships effectively.

Additionally, the certification process often includes rigorous assessments and practical evaluations, which can be daunting for some contractors. However, successful completion can lead to enhanced credibility and trust among clients, as certified contractors are often seen as more knowledgeable and reliable. This perception can translate into increased business opportunities, as clients tend to prefer working with certified professionals who can guarantee compliance with industry standards and best practices. Therefore, while the path to vendor certification may be fraught with challenges, the long-term benefits can significantly outweigh the initial hurdles faced by contractors in their pursuit of excellence.

Protecting Your Business: Practical Insurance Advice

Telecom and data cabling contractors should consider a comprehensive insurance package tailored to their specific risks. General liability insurance covers common risks like property damage and bodily injury on job sites. Technology errors and omissions insurance protects against claims related to installation mistakes or system failures. Cyber insurance safeguards against data breaches and cyberattacks, which are increasingly relevant in today’s connected world.

Workers’ compensation insurance is mandatory in New York for businesses with employees, covering medical expenses and lost wages from workplace injuries. Commercial auto insurance is also critical if vehicles are used for business operations.

Choosing the right insurance provider can be challenging given the limited market in New York. Contractors should work with brokers who understand the local regulatory environment and can help navigate the complexities of coverage options and premium costs.

Insurance Coverage Comparison for Telecom Contractors

| Coverage Type | Purpose | Typical Cost | Why It Matters |

|---|---|---|---|

| General Liability | Covers bodily injury and property damage | Varies; higher in NY due to Scaffold Law | Protects against common job site accidents and claims |

| Technology Errors & Omissions (Tech E&O) | Protects against claims of technology service failures | About $59/month | Essential for telecom companies handling tech installations |

| Cyber Insurance | Covers data breaches and cyberattacks | Varies based on risk profile | Mitigates financial impact of cyber incidents |

| Workers’ Compensation | Covers employee injuries on the job | Based on payroll and risk | Mandatory in NY; protects employees and business |

| Commercial Auto | Covers vehicles used for business | Varies by vehicle and usage | Protects against vehicle-related liabilities |

What to Remember When Choosing Insurance in New York

New York’s legal and insurance environment presents unique challenges for telecom and data cabling contractors. The Scaffold Law affects liability coverage availability and pricing, making it essential to shop carefully and plan for higher premiums.

Technology errors and omissions insurance is a cost-effective way to protect against professional risks, while cyber insurance addresses the growing threat of data breaches. General liability remains a must-have, but workers’ compensation and commercial auto insurance should not be overlooked.

Working with knowledgeable brokers who understand New York’s market can help contractors find the right balance of coverage and cost. Staying informed about compensation trends, purchasing habits, and vendor certification demands also helps contractors manage operational risks alongside insurance needs.

For contractors looking to learn more about insurance options tailored to their industry, resources like

Insureon’s guide for telecom cabling installers provide practical advice and coverage insights.

Frequently Asked Questions

Q: Why is insurance more expensive for contractors in New York?

A: New York’s Scaffold Law increases liability risks, causing many insurers to leave the market and driving up premiums by 20% or more.

Q: What is technology errors and omissions insurance?

A: It protects telecom contractors from claims related to mistakes or failures in technology services or installations.

Q: Is cyber insurance necessary for telecom contractors?

A: Yes. Handling sensitive data and networks exposes contractors to cyber risks that this insurance helps cover.

Q: How does vendor certification affect cabling contractors?

A: Certification requires training that can reduce working time, impacting productivity and profitability.

Q: What percentage of cabling contractors purchase through distributors?

A: About 73.5% of cabling contractors buy materials through distributors, influencing supply and pricing.

Q: Can contractors find affordable tech E&O insurance in New York?

A: Yes. Tech E&O insurance typically costs around $59 per month, making it a practical coverage option.

Q: What should contractors prioritize when selecting insurance?

A: Focus on general liability, tech E&O, cyber insurance, and workers’ compensation to cover the main areas of risk.